The Financial Sector Assessment Program is a key pillar of IMF surveillance. It undertakes a deep-dive into potential systemic risks to financial stability, including by conducting “stress tests” to gauge the ability of financial institutions to withstand adverse shocks to the economy. FSAPs also evaluate the strength of supervisory and regulatory frameworks to mitigate risks, and the adequacy of crisis management tools and safety nets to handle threats that may materialize.

FSAPs can help make financial systems more resilient. In doing so, they consider country-specific features and tailor their analysis. The IMF assesses advanced economies itself and evaluates others jointly with the World Bank.

Many countries entered the pandemic with strong bank capital and supervisory frameworks. Nonetheless, as economies recover from the pandemic, uncertainties remain regarding the underlying state of banks and other intermediaries.

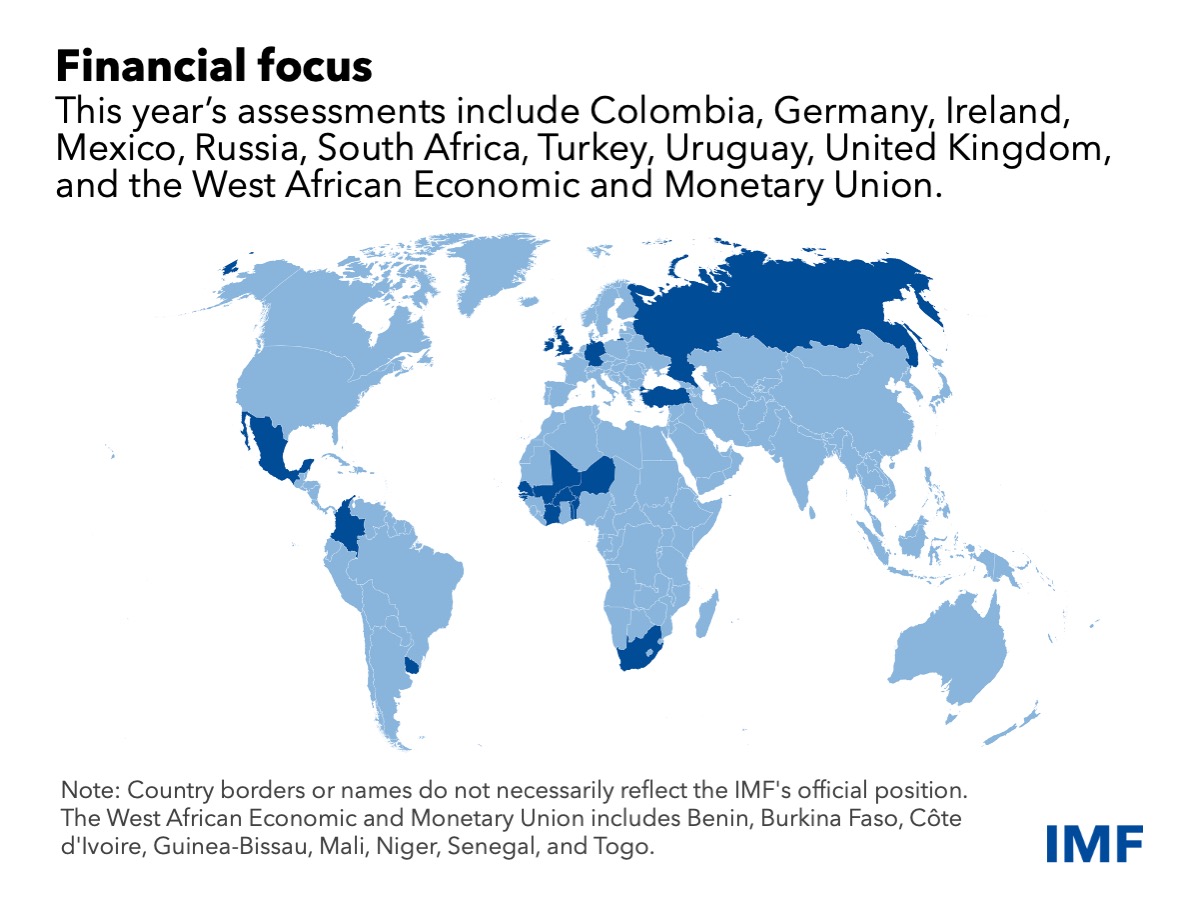

This year’s assessments address seven economies with systemically important financial sectors: Germany, United Kingdom, Mexico, Russia, Turkey and Ireland, which are reviewed every five years, and South Africa, which is assessed once every 10 years. The others, which requested the assessments themselves, are Colombia, Uruguay and the West African Economic and Monetary Union.

FSAPs scheduled to conclude this year include:

Colombia

The Colombian economy has a large and complex financial system dominated by conglomerates with significant presence in Central America. The FSAP will assess the soundness and resilience of banks to adverse economic shocks; perform interconnectedness and contagion analysis, corporate stress testing analysis, and explore transition risks arising from climate change. The assessment will also evaluate bank oversight, macroprudential policy, and safety-net arrangements. The World Bank will focus on the role of the state, competition in the financial sector, digital financial inclusion, insurance supervision, insolvency regimes and creditor rights.

Germany

Banks dominate the financial sector, which includes two globally systemic-lenders, a large insurer, and one of the largest global central counterparties. Europe’s largest economy enjoyed favorable economic conditions and strong buffers before the pandemic. The FSAP will assess the financial stability implications of structural vulnerabilities associated with low banking profitability and price misalignments in the real estate sector. It will analyze the risks of adverse economic shocks such as a global resurgence of COVID-19, inflationary pressures, and implications of any shift in market sentiment against some high-debt euro area countries. The FSAP will also assess the institutional framework for macroprudential policy and the strategy for setting policy tools; conduct targeted assessments of Germany's banking and insurance regulation and supervision, financial crisis management arrangements, deposit insurance, and institutional protection schemes; and do a deep dive assessment of the systemic financial infrastructure. The FSAP will also profile climate transition risks, analyzing their impact on banks, and will cover regulatory aspects of financial technology.

Ireland

This financial system has grown significantly, especially since Brexit, with many international institutions increasing their presence. The market-based financial (MBF) sector, the largest component of the financial system, is now the second largest in Europe, behind Luxembourg. The authorities have strengthened the supervisory framework considerably since the 2016 FSAP. Cross-cutting themes include the post-Brexit landscape of the financial sector, climate change, and the gradual phasing out of extraordinary COVID-19 support. The FSAP will examine the effectiveness of supervision of banking, insurance, and MBF, conduct stress testing, assess the frameworks for macroprudential policy, and that of financial safety net and crisis management, and analyze interconnectedness of the MBF sector. The FSAP will also assess insolvency and creditor rights, given comparatively low collateral recovery rates in Ireland.

Mexico

Latin America’s second-largest economy is tightly integrated with global trade and finance. It benefits from large buffers in the banking system. The FSAP comes amid rising risks from continued pandemic disruptions and the possibility of a sharp tightening in global financial conditions or capital flow volatility. The assessment will examine the financial sector's resilience, including to system-wide liquidity shocks, financial sector oversight and crisis management, and challenges and opportunities stemming from climate change, cyber security, and fintech.

Russia

Russia’s financial system is bank dominated, largely state-owned and concentrated. Key risks include intensified economic sanctions, reliance on emission-intensive exports, rapid credit growth in riskier retail segments, and dominant banks expanding non-core businesses. The FSAP will examine progress in developing macroprudential policy tools, upgrading banking regulation and supervision, and strengthening securities oversight and crisis management and resolution arrangements. The systemic risk assessment will encompass bank solvency and liquidity stress tests and the impact of various climate policy scenarios on the economy and banks.

South Africa

The home of Africa’s largest financial sector features big cross-border banking groups and a well-developed investment fund and insurance sector. The assessment will examine financial strength amid subdued economic growth and large fiscal deficits, exacerbated by weak financial positions of state-owned enterprises and the ongoing pandemic. The assessment will also examine banking, insurance, and securities markets; pension and cyber risk supervision; crisis management and resolution; fintech; financial inclusion; climate risk; and capital markets development.

Turkey

Turkey’s bank-dominated financial system has grown rapidly in recent years. The FSAP will examine systemic risks amid a challenging macroeconomic environment. It will analyze the resilience of the banking and corporate sectors to adverse shocks, along with bank-corporate-sovereign interlinkages. Other evaluations will include the strength of banking supervision and regulation, the macroprudential framework, systemic liquidity management, the crisis management framework, and cyber risks.

Uruguay

Uruguay is a small, open economy with a heavily dollarized financial system and a high participation of state banks. The system has withstood the pandemic due, in part, to extensive policy support deployed by the authorities. The assessment will focus on the resilience of the financial system to a resurgence in the pandemic, and a possible rise in global borrowing costs. It will evaluate the effectiveness of bank supervision (jointly with the World Bank); the macroprudential policy framework, including measures to tackle dollarization; crisis-management arrangements; and financial integrity. The World Bank will also focus on the role of the state and prospects for developing capital markets further.

United Kingdom

The FSAP was discussed with national authorities along with the conclusions of the Article IV consultations in December. It recognized swift policy actions at the onset of the pandemic to restore market liquidity and maintain financial stability. The soundness of UK banks and insurers has increased since the 2008 Global Financial Crisis and they are well placed to face near-term challenges. The FSAP assessed the financial stability framework as resilient and pointed out opportunities for continued enhancements. Many of these are cross-border in nature and require international cooperation, including the bridging of data gaps in the nonbank financial institutions subsector. The FSAP highlighted the UK’s leadership on managing future risks such as climate and cyber resilience and noted the importance of preserving the primacy of financial stability objectives.

West African Economic and Monetary Union

The banking sector has grown rapidly in member nations Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo. Intra- and extra-regional banking groups now play dominant roles among lenders, and government debt constitutes a critical part of banks’ portfolios. The FSAP is evaluating the strength of the financial sector amid uncertainty about global inflation and growth. In this context, the FSAP is developing tail-risk scenarios for economic growth and inflation and assessing systemic liquidity management and macroprudential policy. The FSAP is also examining banking regulation and supervision; crisis management and bank resolution; access to finance; payment systems; climate risk; capital markets development; and the role of state-owned banks.